[disclose]

If you’ve ever felt the pain of having a trip delayed or canceled you’re not alone. As much as we travel, we’ve been pretty lucky to date that we haven’t been victims of this more often. To protect us when there is a problem we make sure we purchase our tickets with a credit card that will help mitigate the inconvenience.

Is this your bag? Photo: Chris Waits via Flickr, used under Creative Commons License (By 2.0)

Most major credit cards offer some sort of trip cancellation or trip interruption policy. However, each card isn’t cut from the same mold. The main benefits we look for provide:

- Reimbursement for nonrefundable or prepaid hotels, airfare and tours if your trip is cut short by sickness or severe weather.

- Lost and delayed luggage coverage.

- Food and lodging expenses for trip delays on common carriers

We especially like these card for the coverage provided when there is a problem.

Chase Sapphire Preferred

- Trip cancellation/interruption — you may be reimbursed up to $10,000 for non-refundable expenses if your trip is canceled or cut short by sickness or severe weather

- Baggage delay — reimburses you for essential purchases like toiletries and clothing for baggage delays over 6 hours by passenger carrier up to $100 a day for 5 days

- Lost baggage — reimbursement up to $3,000 per insured person per covered trip

- Trip delay — travel is delayed more than 12 hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, such as meals and lodging, up to $500 per ticket

Citi ThankYou Premier

- Trip cancellation/interruption — you may be reimbursed up to $5,000 per covered traveler per trip if it is cancelled, interrupted or extended for a covered reason. We especially like that a covered reason also includes loss of a job.

- Baggage delay — covered up to $100 per covered traveler if you baggage doesn’t arrive within 6 hours of your arrival

- Lost baggage — maximum of $3,000 reimbursed for baggage that is lost, stolen or damaged by the common carrier

- Trip Delay — up to $500 reimbursed per traveler

Make sure you book the entirety of your trip with a card that covered these items — not only for yourself but for anyone else travelling with you.

=====

To make sure you receive our latest deals, LIKE our The Flight Deal Facebook Page, follow us on Twitter @TheFlightDeal, Threads @TheFlightDeal or The Flight Deal WhatsApp channel or subscribe to The Flight Deal RSS Feed or Subscribe via Email (Once a Day)

The Flight Deal does not sell travel products or services. We provide you with information about third-party travel suppliers’ offers, and link you to their sites. The information posted by The Flight Deal is valid at the time of publication. However, we have no control over the suppliers, and we therefore do not warrant or guarantee that their offers will not change or become unavailable. Nor are we responsible for their products, services or site content. Please see their sites for their most up-to-date offer information and all applicable terms and conditions.

Sign up to receive The Flight Deal Daily DealsLetter, to stay up to date with the latest and greatest flight deals available.

I’m curious about cancellation due to travel bans. Even though the travel ban may not extend to the traveler, the way that TSA has been operating makes me very anxious about a forthcoming summer trip. Any advice?

For Chase, it’s not specifically mentioned as a covered option so we doubt it’s covered (it’s not mentioned as a NOT covered option either though)

Beware Citi. Their benefits administrator does everything it can to deny valid claims. It’s benefits are also more narrowly written, despite generous sounding terms. Chase and Amex much better and actually come through when you need them.

How does cancellation work for “sickness”? Do you need evidence of a doctor’s visit? Does it need to be some serious ailment? My wife just took a flight while having a miserable cold because we would have lost the flight and needed to rebook at an awful price. What is the cancellation amount determined on? Is it for an airline cancellation fee, or maybe the amount you originally paid? I assume they wouldn’t pay for rebooking, but maybe they would pay a change fee. And I also wonder about award tickets- does it tend to get covered if you put the taxes or fees on that credit card?

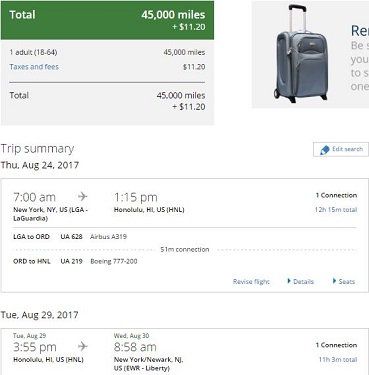

This is what Chase has to say – sickness is defined as an illness or disease which is diagnosed or treated by a Physician after an Insured Person’s effective date of coverage under the Policy. Be prepared with your doctor’s note that specifically mentions why flying or taking your trip would be against his recommendation. Generally the amount paid and not refundable is the claim amount. Rewards are paid back at a rate of 1 cent per point unless the monetary value is displayed on the itinerary or redemption confirmation. Furthermore only programs affiliated with a Chase card are eligible for refunds such as United, Hyatt, and Southwest.