[disclose]

Generally, airfare in the Summer and during the holidays are most expensive. We like to book with with points during those seasons when the cost for airfare is normally higher.

However we do keep an eye out for flight deals for peak travel use. How do we decide to buy versus using points? A good rule to follow: the cost for your redemption should be greater 2 cents per mile (CPM). It’s best to explain with an example here.

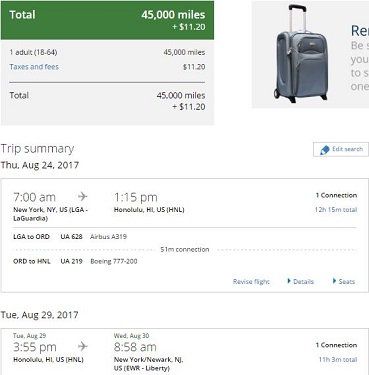

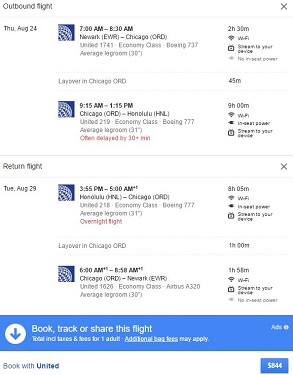

We love Hawaii but it’s a very popular destination. In our example, you can purchase a ticket in the summer for $844 or book the same flights for 45,000 points. This represents United’s Saver level economy award.

To calculate the CPM, subtract the cost of the award fee from the paid ticket then divide that by the miles: ($844 – $11.20) / 45,000 = .0185. An okay / borderline redemption. It’s a good start on the buy vs redemption debate. One factor you may consider important is a paid ticket would help you with elite qualification but you can decide what’s important for you.

If you do decide to pay for the fare please at least gain extra miles and points for that purchase. Use a credit card that get you points or some form of incentive such as cash back. Even better, use a credit card that gets you extra points for the travel category.

Our strategy as you can see is simple: try to use miles/points when tickets are expensive and when we can get 2 cents per mile/point, cash when tickets are cheap.

Here are the short list of cards we use when we purchase airfare.

American Express Platinum Card

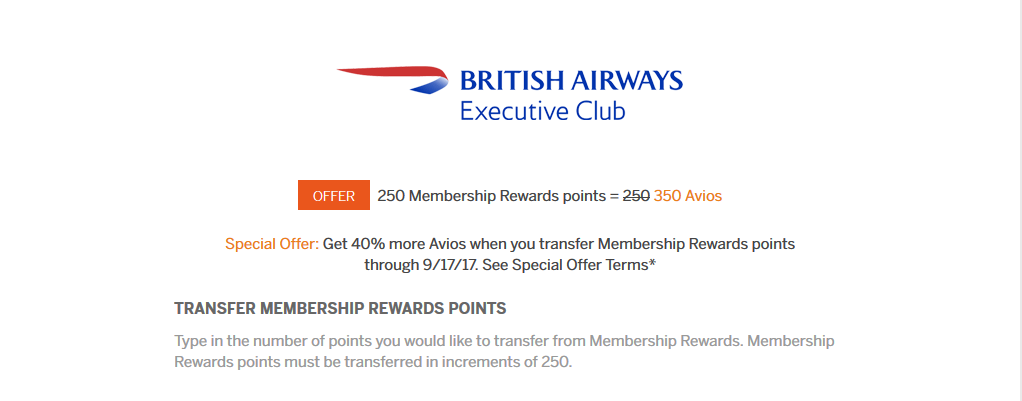

Why we like it — 5x points on tickets purchased directly with Airlines or with American Express Travel; Amex Offers can make that even more lucrative – currently there is a targeted offer of 20,000 bonus points if you make a $1000 purchase with Air France. In the past we’ve seen offers such as $200 off $1000 spend with Delta. You can also get credited $200 back for spend on airline fees. Those fees are can be open to interpretation and your mileage may vary.

Chase Sapphire Reserve

Why we like it — 3x points on travel (airfare, tickets, parking, etc) along with a $300 travel credit make this a go to card.

Other good choices include airline issued cards which get you 2x miles on tickets purchased with the carrier, priority boarding, first checked bag free, and no foreign transactions fees. Citi AAdvantage Platinum Select World Elite Mastercard, United MileagePlus Explorer Card, and the Gold Delta SkyMiles card have made their way into our wallets too.

=====

To make sure you receive our latest deals, LIKE our The Flight Deal Facebook Page, follow us on Twitter @TheFlightDeal, Threads @TheFlightDeal or The Flight Deal WhatsApp channel or subscribe to The Flight Deal RSS Feed or Subscribe via Email (Once a Day)

The Flight Deal does not sell travel products or services. We provide you with information about third-party travel suppliers’ offers, and link you to their sites. The information posted by The Flight Deal is valid at the time of publication. However, we have no control over the suppliers, and we therefore do not warrant or guarantee that their offers will not change or become unavailable. Nor are we responsible for their products, services or site content. Please see their sites for their most up-to-date offer information and all applicable terms and conditions.

Sign up to receive The Flight Deal Daily DealsLetter, to stay up to date with the latest and greatest flight deals available.

What do you consider a good redemption value?